Le magnétisme terrestre

La compréhension du magnétisme terrestre a constitué un pas très important dans la formulation de la théorie de la tectonique des plaques. Deux aspects du magnétisme retiennent l'attention: le paléomagnétisme et les inversions du magnétisme terrestre. La découverte de bandes d'anomalies magnétiques sur les planchers océaniques parallèles aux dorsales est venue cautionner la théorie de l'étalement des fonds océaniques de Hesse.

1 - Le Paléomagnétisme

Bien que les Chinois aient découvert les premiers le magnétisme terrestre dès l'an 1040, il revient à William Gilbert, physicien et médecin de la reine Elisabeth I d'Angleterre au 16e siècle, d'avoir réalisé que si l'aiguille aimantée d'une boussole pointe invariablement vers le Nord, c'est qu'il y a quelque chose, une sorte d'aimant placé au centre de la terre, et qu'il devient possible de calculer la direction et l'intensité du champ magnétique en tout point de la surface du globe.

Il aura fallu attendre près de deux siècles, soit vers la fin du 19e siècle, pour qu'on développe le magnétomètre, un appareil capable de mesurer l'intensité du champ magnétique, ouvrant la porte à l'exploration quantitative du champ magnétique terrestre. On se rend compte alors qu'il y a des anomalies, i.e. des différences entre les intensités mesurées en un lieu donné et les intensités théoriques calculées selon l'hypothèse de Gilbert: anomalie positive (champ réel > champ théorique) et anomalie négative (champ réel < champ théorique).

Le physicien napolitain Macedonio Melloni (1853) découvre que chaque roche volcanique possède sa propre aimantation. Il formule l'hypothèse que cette aimantation a été acquise lors du refroidissement de la lave qui enregistre le champ magnétique terrestre de l'époque. Les laves possèdent donc une "mémoire magnétique". Deux chercheurs français, Brunhes (1906) et Mercanton (1910 à 1930), confortent la découverte de Melloni en y apportant les fondements théoriques. Il a cependant fallu attendre l'après-guerre pour voir une utilisation intensive de cette "mémoire magnétique".

C'est une percée technologique qui a lancé toute l'histoire. En 1952, le physicien anglais Patrick Blackett, prix Nobel en 1948, invente, au cours de recherches sur les relations entre le magnétisme terrestre et la rotation de la terre, le magnétomètre astatique, capable de mesurer des champs magnétiques extrêmement faibles. En 1959, avec ses collaborateurs Keith Runcorn et Ted Irving, il utilise l'appareil pour mesurer la mémoire magnétique des roches; c'est la naissance d'une discipline qu'on appelle aujourd'hui le paléomagnétisme. On se rend compte que grâce à cette mémoire, on peut déterminer la position des pôles magnétiques pour diverses périodes géologiques à partir de roches dont l'âge est connu. Runcorn propose de définir, époque par époque, la position d'un paléo-pôle magnétique pour diverses régions, un travail minutieux qui consiste d'abord à définir pour l'Europe, une trajectoire de la "promenade des pôles" (polar wandering) à travers les temps géologiques, puis ensuite de faire le même exercice pour l'Amérique.

La carte ci-dessous présente une vue de l'hémisphère Nord centrée sur le pôle Nord magnétique, selon la géographie actuelle. Le trait rouge indique la trajectoire apparente du pôle nord magnétique terrestre établie à partir de plusieurs mesures du paléomagnétisme sur des échantillons datant de l'Éocène au Cambrien, prélevés sur le continent européen. En trait bleu, c'est la trajectoire établie à partir d'échantillons datant de l'Éocène au Silurien, prélevés sur le continent nord-américain. En trait vert, c'est la trajectoire établie à partir d'échantillons datant de l'Éocène au Jurassique, prélevés en Inde. E=Éocène (50 Ma); J=Jurassique (175 Ma); T=Trias (225 Ma); P=Permien (260 Ma); Ca=Carbonifère (320 Ma); S=Silurien (420 Ma); Cb=Cambrien (530 Ma). Les âges absolus (entre parenthèses) correspondent au milieu de la période mentionnée.

Wegener avait supposé que la Pangée avait existé depuis l'origine de la terre et qu'elle n'avait commencé à se disloquer qu'autour des 200 Ma. La dérive des continents étaient pour lui un phénomène irréversible: morcellement d'un mégacontinent originel en parties de plus en plus petites. Mais les paléomagnéticiens (certains disent les paléomagiciens!) ne se sont pas arrêtés aux derniers 200 Ma. Ils ont reculé jusqu'au début du Paléozoïque pour se rendre compte qu'il y a eu des dérives continentales plus anciennes, antérieures à 300 Ma. Mais, toutes ces reconstitutions laissèrent sceptique la communauté scientifique des années 50-début 60; de nombreuses objections seront soulevées. Le tout-puissant physicien Harold Jeffreys, adversaire irréductible de tout mobilisme, ira jusqu'à écrire que le marteau utilisé pour le prélèvement des échantillons est responsable de l'aimantation!

On sait aujourd'hui, grâce à la théorie de la tectonique des plaques, que les continents ont bougé tout au long de l'histoire géologique, et le paléomagnétisme est utilisé comme outil de base pour reconstituer la position des continents aux diverses époques géologiques (voir section 4: Histoire de la Planète).

2 - Les Inversions du Magnétisme terrestre

En 1906, Brunhes découvre que non seulement les laves ont une mémoire magnétique, mais aussi que certaines montrent des inversions du magnétisme; en d'autres termes, que le dipôle Nord-Sud aurait été à certaines époques Sud-Nord. A la même époque, le japonais Matuyama ajoute une notion temporelle à ces inversions. Il date diverses coulées de laves et conclut à l'existence d'inversions multiples à travers les temps géologiques. Les conclusions de Matuyama tombent dans l'indifférence et l'oubli pour une période de près de 50 ans, jusqu'à ce que les américains qui prenaient beaucoup leurs distances par rapport à l'application du paléomagnétisme aux dérives continentales se passionnent pour les inversions de polarité magnétique.

Le physicien américain J. Graham (1950) a été en quelque sorte l'étincelle dans le renouveau d'intérêt pour les inversions. Il avait émis l'idée que les inversions de polarité magnétique ne sont pas dues à une inversion du champ magnétique terrestre comme l'avait proposé Matuyama, mais à un phénomène bien connu en physique des solides, l'auto-inversion, qui interviendrait lors de la cristallisation de certains minéraux. Bien que fausse, cette proposition a eu le mérite d'avoir amorcé un débat qui remit à l'ordre du jour le paléomagnétisme.

En 1960, John Reynolds du département de physique de Berkeley (Californie) et John Verhoogen du département de géologie de la même université unissent leurs efforts pour étudier des basaltes: l'un met au point une méthode de datation isotopique permettant d'avoir des âges précis, l'autre s'applique à obtenir des mesures fiables d'orientation du paléomagnétisme sur les mêmes échantillons. Ils démontrent rapidement le bien-fondé des conclusions de Matuyama. Walter Elsasser de l'Université Princeton et Ted Bullard de Cambridge en Grande Bretagne développent l'idée d'une dynamo centrale située dans le noyau terrestre. Pour expliquer les retournements épisodiques du champ magnétique, ils conçoivent que cette dynamo pourrait présenter des comportements instables.

Finalement, la réalité des inversions du champ magnétique va être démontrée entre 1960 et 1966 par deux équipes issues de Berkeley: une équipe du USGS (United State Geological Survey) en Californie composée d'Alan Cox, Richard Doell et Brant Dalrymple, et une équipe de l'ANU (Australian National University) formée de Ian McDougall et François Chamalun. A partir de laves relativement récentes, ils construisent ensemble une échelle des inversions de la polarité magnétique pour les derniers 4 Ma, une échelle applicable aux U.S.A., à l'Europe, au Pacifique et à l'Australie, et qui a valeur mondiale.

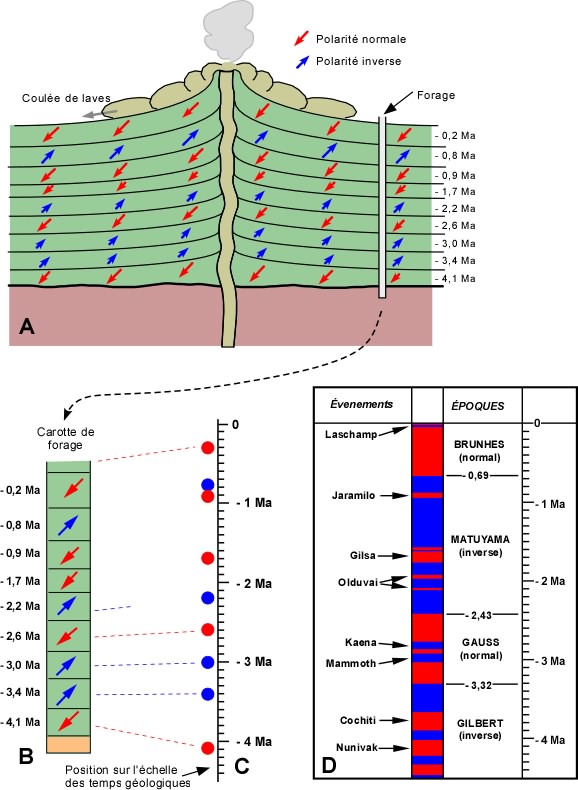

Les schémas qui suivent expliquent comment on a utilisé les inversions du champ magnétique terrestre pour construire une échelle magnétostratigraphique.

Durant cette période de temps, il y a eu plusieurs inversions (indiquées par les changements de couleurs), mais on fait des regroupements en époques et en événements. Il y a eu des époques où c'est la polarité normale (en rouge) qui a dominé (Bruhnes, Gauss) et des époques où c'est la polarité inverse (Matuyama, Gilbert). A noter que les époques ont été dédiées aux grands pionniers de notre compréhension du magnétisme terrestre, alors que les événements portent des noms de lieux.

Voici un exercice pour vous aider à mieux comprendre comment on a construit l'échelle magnétostratigraphique.

3. Les Anomalies magnétiques des Planchers océaniques

Lors des premières phases de l'exploration des fonds océaniques, les relevés de l'intensité du champ magnétique à l'aide d'un magnétomètre tiré par un bateau avaient montré l'existence, sur ces fonds, d'une alternance de bandes parallèles de magnétisme faible et de magnétisme élevé. On s'expliquait mal cette situation.